Global Islamic

Finance Advisors

Winner of Islamic Economy Knowledge Infrastructure Award Global Islamic Economy Summit

We won the "Best Shariah Advisory Firm" award!

We are very honored to have won the “Best Shariah Advisory Firm” award in the recent IFN Service Providers Award 2022 as voted by the industry market players and peers.

Our sincerest thanks and appreciation to all of our clients, contacts, friends and followers around the world for your ongoing support and trust in us. It is our commitment to continue improving and strive to provide better quality services to our valued clients and everyone.

For any inquiries, please reach us at info@amanieadvisors.com

We are the shariah minds

Amanie Advisors is a leading Shariah advisory firm specializing in Islamic finance solutions covering a wide range of services including Shariah advisory and consultancy, training and research & development for institutional and corporate clientele focusing on Islamic financial services.

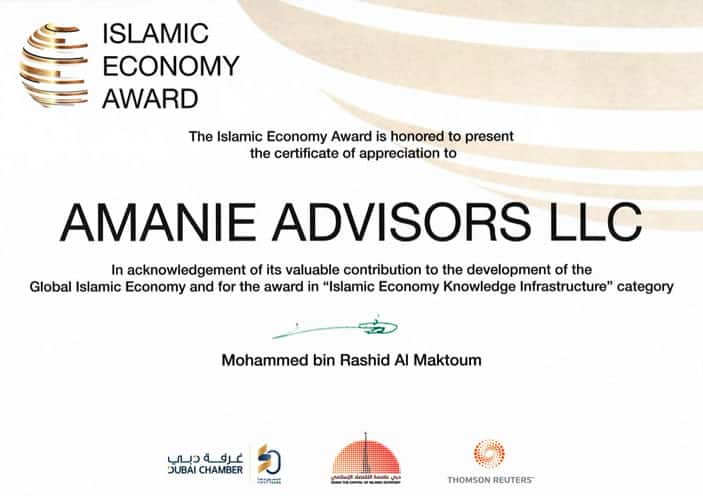

Islamic Economy Award

Amanie Advisors won the Islamic Economy Award in the category of Islamic Economy Knowledge Infrastructure at the prestigious Global Islamic Economy Summit (GIES) in Dubai, UAE as delivered by His Highness Sheikh Mohammed bin Rashid Al Maktoum, the Vice President and Prime Minister of UAE

+

Completed Projects

+

Worldwide Client

+

Total Awards

+

Years Experience

+

Consultants

Our Clients

Our Awards

The world of Shariah minds

Our global presence is perfectly positioned to offer international perspective and global best practices to clients around the world.

Our Services

Public / Private Equity Funds

Structured Product

Sukuk

Conversion / Establishment

Projects

Shariah Advisory and Shariah Board Services

Shariah Audit

Amanie Shariah supervisory board

DR. MOHAMED ALI

ELGARI

Chairman

Dr. Mohamed Ali Elgari was previously a Professor of Islamic Economics and the former Director of the Centre for Research in Islamic Economics at King Abdul Aziz University in Saudi Arabia. Dr. Ali Elgari is an advisor to several Islamic financial institutions throughout the world and is also on the Shariah board of the Dow Jones Islamic index. He is a member of, amongst others, the following Shariah Supervisory Boards, Dubai Islamic Bank, Credit Suisse, Merrill Lynch & Co, Rasmala Investments, UBS Islamic Finance, Saudi American Bank, Al Bank Al Saudi Al Fransi, FWU Group, Citi Islamic Investment Bank , HSBC Amanah Takaful Malaysia. He is also a member of the Islamic Fiqh Academy as well as the Islamic Accounting & Auditing Organisation for Islamic Financial Institution (AAIOFI) and International Islamic Financial Market (IIFM). Dr. Elgari has written several books on Islamic banking. He graduated from the University of California with a Ph.D. in Economics.

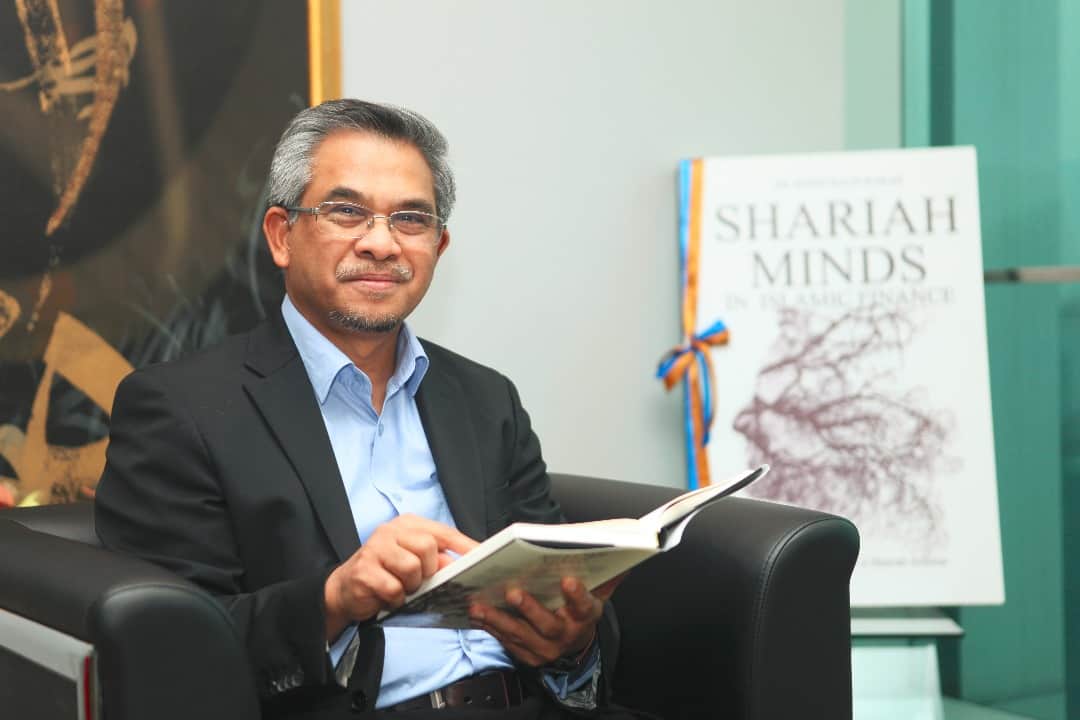

DR. MOHD DAUD

BAKAR

Executive member

Dr. Mohd Daud Bakar received his first degree in Shariah from University of Kuwait in 1988 and obtained his Ph.D. from University of St. Andrews, United Kingdom in 1993. In 2002, he went on to complete his external Bachelor of Jurisprudence at University of Malaya. He is currently the Chairman of the Shariah Advisory Council at the Central Bank of Malaysia, the Securities Commission of Malaysia and the International Shari’ah Research Academy for Islamic Finance (ISRA) Council of Scholars. Dr Bakar has published a number of articles in various academic journals and has made many presentations in various conferences both local and overseas. Dr. Bakar is currently the President of the International Islamic University Malaysia.

Dr. Mohd Daud Bakar is currently the Shariah board member of Dow Jones Islamic Market Index (New York), First Abu Dhabi Bank (Chairman), National Bank of Fujairah, Morgan Stanley (Dubai), Societe Generale (Dubai), Credit Agricole (Dubai), National Bank of Oman, Financial Guidance (USA), BNP Paribas (Bahrain), Gulf International Bank, Bank Al Khair (Bahrain), Bank of London and Middle East (London), amongst many others.

DR. MUHAMMAD AMIN

ALI QATTAN

Member

Dr. Qattan has a Ph.D. in Islamic Banking from Birmingham University and is himself a lecturer as well as a prolific author of texts and articles on Islamic economics and finance. He is currently the Director of Islamic Economics Unit, Centre of Excellence in Management at Kuwait University. Dr. Qattan also serves as the Shariah advisor to many reputable institutions such as Ratings Intelligence, Standard & Poors Shariah Indices, Campo d’oro SA, Monumental Venture (Suisse), Al Fajer Retakaful amongst others. He is a highly regarded Shariah Scholar and is based in Kuwait.

DR. OSAMA

AL DEREAI

Member

Dr. Osama Al Dereai is a Shariah scholar which has an extensive experience in teaching, consulting and research in the field of Islamic finance. He received his Bachelor’s degree specializing in the Science of Hadeth Al Sharef from the prestigious Islamic University of Madina. Dr. Al Dereai obtained his Masters degree from the International Islamic University (Malaysia) and was later conferred his Doctorate in Islamic Transactions from the University of Malaya. Dr. Al Dereai is a Shariah board member of various financial institutions which include the First Leasing Company, Barwa Bank, Barwa Capital (UK), First Investment Company and Ghanim Al Saad Group of Companies, Asian Islamic Investment Management Sdn. Bhd. Dlala Islamic Brokerage Company (W.L.L) First Finance Company (Q.S.C.) amongst others.

Our Team

Global office

Dubai

Maya Marissa Malek

Executive Director,

Global Shariah Advisory

Chief Executive Officer,

Amanie Advisors Global Office

Maya Marissa Malek joined Amanie Advisors Malaysia since 2007 and is one of the pioneers in the firm and the first woman advisor. She is currently the Executive Director for Global Shariah Advisory and Compliance business for the global Amanie Group and the Managing Director of Amanie Advisors’ global office, based in Dubai.

In Shariah advisory, an area where the presence of women is scarce, Maya has gone far in making her mark in the Islamic finance space. She is a specialist in the areas of Islamic finance framework, Shariah governance, structuring, enhancement and conversion exercises, establishment of Islamic financial entities as well as development of Islamic finance policies and standards. She has been instrumental in many innovative and landmark Islamic financial instruments globally as well as active in numerous developmental initiatives for the Islamic finance market. Having the privilege to work closely with many globally renowned Shariah scholars, Maya has learnt valuable knowledge and traits which can only be found from real life experiences and has used this enriching know how to elevate her advisory modus operandi. Her profession in and passion for Islamic finance has taken her around the globe creating awareness on Islamic finance. Markets and areas untapped by Islamic finance are her prime interests, challenging her and her team to innovate and create demand for Islamic finance to take root.

Maya comes from a legal background and has more than 18 years’ experience mainly in corporate legal and Islamic finance matters. Maya is active on many fronts globally for initiating new and innovative Islamic finance solutions for the industry as well as empowering women in Islamic finance. She is also a member of the Green Sukuk Working Group in the UAE and a Shariah consultant for the IFC World Bank Group.

Aiman Aizuddin Rashid

Associate Director,

Global Shariah Advisory

Amanie Advisors Global Office

Aiman Aizuddin is an Associate Director of Amanie Advisors Dubai, UAE office and joined Amanie since 2014. Aiman specializes in the legal and Shariah aspects of Shariah-compliant financial products and services. He is a certified Shariah Advisor & Auditor (CSAA) by AAOIFI Bahrain, a certified Islamic Banker (CIB) & Islamic Specialist in Capital Markets (CISCAM) by CIBAFI and a qualified lawyer by the Malaysian Bar. Aiman has been involved in the structuring, development and enhancement of Islamic banking products for Islamic Financial Institutions/Islamic Window operations in GCC, Europe and South East Asia. He also has advised on Sukuk structures, structured public and private equity funds and developed the Shariah Governance Framework and Shariah guidelines at both the national and financial institution level. His advisory clients include Tier 1-3 International Banks, top Asset Management companies, Central Banks, International Exchange houses as well as SMEs. Prior to joining Amanie, Aiman was a lawyer with Zaid Ibrahim & Co (ZICOlaw), Malaysia’s largest law firm and concurrently was as a Consultant with the group’s Shariah Advisory Company (ZICO Shariah) advising on both, the legal and Shariah aspects of Islamic Finance. Aiman holds an MA in Islamic Finance from Durham University UK and a Bachelor of Laws with Shariah Laws degree from the International Islamic University of Malaysia.

Sharafie

Mohd Daud

Senior Associate

Global Shariah Advisory,

Amanie Advisors Global Office

Sharafie Mohd Daud is currently a Consultant with Amanie Advisors Global Office located in Dubai. His last post before joining Amanie was Assistant Vice President, Shariah Compliance with Al Rajhi Bank in Malaysia where he was tasked to setup a new unit under Compliance division; responsible of undertaking Shariah review. Prior to that, he spent more than 5 years working in multiple department within HSBC Amanah Malaysia Berhad; such as Shariah, Debt Capital Market as well as Commercial Banking department. He has experience in Shariah advisory, Shariah review, product development, been involved in Sukuk transaction and managing corporate products. He also had a stint in Affin Islamic as an executive. Sharafie holds a bachelor’s degree in Shariah from Yarmouk University in Jordan.

Idris

Mojaddidi

Senior Associate

Global Shariah Advisory,

Amanie Advisors Global Office

Idris Mojaddidi is a Consultant with Amanie Advisors’ global office, based in Dubai. He is a specialist in the area of Shariah, Islamic finance, product development, Shariah governance, structuring, enhancement, Shariah audit as well as Anti-corruption. Idris comes from a Shariah background and has more than 15 years’ of working experience with large financial institutions, government agencies and Islamic finance and Shariah advisory firms and has had the privilege to work closely with globally renowned Shariah scholars. Idris has a Post Graduate degree in Islamic finance from AIMS, UK and Shariah law (BA) from Al-Azhar University, Cairo-Egypt. He speaks English, Arabic, Persian and Pashto.

Abdulaziz

Goni

Senior Associate

Global Shariah Advisory, Amanie Advisors Global Office

Abdulaziz Goni has 10 years of experience in the Islamic finance industry. In 2011, he joined Thomson Reuters Malaysia, initially as a client specialist responsible for maintaining relationships with regional clients, mainly fund managers, financial institutions and pension funds – he was part of the team that developed a Bond and Sukuk index that became a benchmark index for Malaysian fund managers. He moved to Dubai in 2016 as a Senior Research Analyst with Refinitiv (formerly part of Thomson Reuters) where he was responsible for writing and publishing reports covering Islamic finance development and quarterly reports on sukuk markets.

Abdulaziz holds a Master’s degree in Islamic finance from INCEIF, and has passed level I of the CFA program.

Azerizan

Johari

Associate

Global Shariah Advisory,

Amanie Advisors Global Office

Comming soon

Head office

Kuala Lumpur

Suhaida

Mahpot

Chief Executive Officer,

Head Office

South East Asia

Suhaida Mahpot is the Chief Executive Officer for Amanie Advisors in Kuala Lumpur office. She joined Amanie in 2008 and was among the pioneers in the company. She is a specialist in sukuk advisory and has been partnering with Datuk Dr Mohd Daud Bakar for the last 10 years to advise on numerous sukuk, locally and internationally. One of the sukuk advised by her has been awarded as Best Securitisation Sukuk at The Asset Triple A Islamic Finance Award (2017). Apart from sukuk advisory, her primary focus is on Shariah governance, structuring, enhancement and conversion exercises, establishment of Islamic financial entities as well as development of Islamic products. She holds a Bachelor of Economics (Islamic Economic & Finance) from International Islamic University Malaysia, and is currently pursuing MSc in Islamic Finance with INCEIF. Her career in banking & financial industry started as a trainee under Capital Market Graduated Trainee Scheme organized by the SC. Prior to joining Amanie, she worked with Affin Investment Bank Bhd since 2006 as an executive for debt & capital markets department. She completed various project financing deals using private debt securities instruments ranging from infrastructure & utilities, real estate, plantation and many others.

Ainul Azura

Zakiyudin

Chief Operating Officer,

Head Office

South East Asia

Ainul Azura Zakiyudin is the Chief Operating Officer of Amanie Advisors Kuala Lumpur, Malaysia office. She holds Bachelor of Law (Honours), MARA University of Technology Malaysia and was admitted to Malaysian BAR as an Advocate and Solicitor of the High Courts of Malaya in 2000.

Azura joined Amanie Advisors (Kuala Lumpur) in 2013 and has been involved in various product structuring, development and enhancement of Shariah compliant products. She has also involved in providing Shariah advisory services for issuance of sukuks, conversion exercises, establishment of Islamic financial business, establishment of Shariah compliant products for non-financial business, Shariah monitoring and compliance review for financial institutions and asset management companies. Prior to joining Amanie, Azura was an in-house legal adviser in PLUS Expressways Berhad (PLUS), where she received wide exposure in corporate legal work and involved directly in the issuance of several sukuks, restructuring of sukuk and other corporate exercises initiated by the company.

Erna Waty

Salihuddin

Senior Consultant

Head Office,

South East Asia

Erna Waty Salihuddin is a Senior Consultant with Amanie Advisors Kuala Lumpur, Malaysia office. She holds a Masters degree of Islamic Finance Practise (MIFP) from International Centre for Education in Islamic Finance University (INCEIF) and obtained her Bachelor of Management Information System (Hons) from International Islamic University (IIUM), Malaysia. Erna has over 16 years of experience in the area of Islamic finance, business advisory, strategic planning and banking operations. Erna joined Amanie Group in 2015, mainly involved with business advisory before joining the Shariah advisory team in 2018. Prior to joining Amanie, Erna was attached to Bank of Tokyo Mitsubishi UFJ (Malaysia) (BTMUM) Islamic Banking department, mainly involved in the establishment of Islamic Banking Window and the issuance of the first Japanese Yen Sukuk.

Prior to joining BTMUM she had a stint in Strategy and Portfolio department, EVP Office of Exploration & Production with Petroliam Nasional Berhad (Petronas) where she was involved in strategic planning of the exploration and production of the oil and gas industry for Malaysia. She started her career in banking since 2004 with HSBC, UOB Bank and PT. Bank Muamalat Indonesia (M’sia).

Ahmad Anas

Fadzil

Senior Consultant

Head Office,

South East Asia

Ahmad Anas Fadzil is a Senior Consultant with Amanie Advisors, based at the Head Office in Kuala Lumpur. As part of Amanie Advisors’s global team, his primary focus is on advising and delivering projects for various Islamic financial services across the globe on their strategic issues and on Shariah compliant products and instruments. Prior to joining Amanie Advisors, he was attached with Sigur Ros for Turkey’s Project of Century: Turkish Republic North Cyprus Water Supply project where he had been assigned as the Project Accountant based in Turkey. Prior to that, he was an auditor with Ernst & Young, attached to Global Financial Services department, engaged in performing auditing work for financial institutions. Ahmad Anas holds a Master of Islamic Finance (MSc) from The Global University of Islamic Finance (INCEIF), is an accounting graduate from MARA University of Technology (UiTM) and holds a professional certification of Certified Islamic Public Accountant (CIPA) from Accounting and Auditing Organisation for Islamic Financial Institution (AAOIFI). He speaks English, Malay and Turkish.

Uzair

Addin

Consultant,

Head Office

South East Asia

Muhammad Hafizuddin is an Assistant Consultant at Amanie Advisors Kuala Lumpur, Malaysia. He graduated with a Bachelor of Business Administration (HONS) Islamic Banking from Universiti Teknologi Mara (UiTM).

Previously, he was internship trainee where he was exposed to the financial and Shariah advisory services such as Shariah stock screening, monitoring and compliance reviewto various clients including financial institutions and global asset management companies. He then started his career in Amanie Advisors Sdn Bhd in December 2018 after he was offered a position there.

Muhammad Hafizuddin Abd Hamid

Associate Consultant,

Head Office

South East Asia

Uzair Addin is a Consultant with Amanie Advisors Head Office, Kuala Lumpur Malaysia. He graduated from Yarmouk University, Jordan with Bachelor of Shariah specializing in Islamic Banking and Economics. Uzair started his journey in Islamic finance industry in the Product Management unit within the Retail Banking department of AmBank Islamic and subsequently joined Hong Leong MSIG Takaful under the Product Development department.

Prior to joining Amanie, Uzair was attached with AmBank Islamic Berhad as the Shariah Review & Compliance officer where he was part of the team responsible for conducting the Shariah review exercise at bank branches and department within AmBank Group. Uzair is a Certified Islamic Banker by the General Council for Islamic Banks and Financial Institutions (CIBAFI), Bahrain.

Europe office

Benjamin Clarehugh

Director Global, Shariah Advisory Europe Office

Benjamin Clarehugh is a Director of Amanie Advisors based in Leeds, United Kingdom.

He is responsible for Shariah screening of equity & fixed income securities, Shariah monitoring & compliance review of unit trust funds and the operation of asset management companies.

Benjamin is also assisting the Shariah advisory team in structuring and developing Islamic Capital Market products. Prior to joining Amanie Advisors Sdn Bhd, he worked with Kuwait Finance House Research Ltd. as a Manager in the Islamic Capital Markets department. He completed various research and advisory/consultancy projects with various global Islamic finance institutions and partners.

Kazakhstan office

Suhaida Mahpot

Chief Executive Officer,

Head Office

South East Asia

Suhaida Mahpot is the Chief Executive Officer for Amanie Advisors in Kuala Lumpur office. She joined Amanie in 2008 and was among the pioneers in the company. She is a specialist in sukuk advisory and has been partnering with Datuk Dr Mohd Daud Bakar for the last 10 years to advise on numerous sukuk, locally and internationally. One of the sukuk advised by her has been awarded as Best Securitisation Sukuk at The Asset Triple A Islamic Finance Award (2017). Apart from sukuk advisory, her primary focus is on Shariah governance, structuring, enhancement and conversion exercises, establishment of Islamic financial entities as well as development of Islamic products. She holds a Bachelor of Economics (Islamic Economic & Finance) from International Islamic University Malaysia, and is currently pursuing MSc in Islamic Finance with INCEIF. Her career in banking & financial industry started as a trainee under Capital Market Graduated Trainee Scheme organized by the SC. Prior to joining Amanie, she worked with Affin Investment Bank Bhd since 2006 as an executive for debt & capital markets department. She completed various project financing deals using private debt securities instruments ranging from infrastructure & utilities, real estate, plantation and many others.

Ainul Azura Zakiyudin

Chief Operating Officer,

Head Office

South East Asia

Ainul Azura Zakiyudin is the Chief Operating Officer of Amanie Advisors Kuala Lumpur, Malaysia office. She holds Bachelor of Law (Honours), MARA University of Technology Malaysia and was admitted to Malaysian BAR as an Advocate and Solicitor of the High Courts of Malaya in 2000.

Azura joined Amanie Advisors (Kuala Lumpur) in 2013 and has been involved in various product structuring, development and enhancement of Shariah compliant products. She has also involved in providing Shariah advisory services for issuance of sukuks, conversion exercises, establishment of Islamic financial business, establishment of Shariah compliant products for non-financial business, Shariah monitoring and compliance review for financial institutions and asset management companies. Prior to joining Amanie, Azura was an in-house legal adviser in PLUS Expressways Berhad (PLUS), where she received wide exposure in corporate legal work and involved directly in the issuance of several sukuks, restructuring of sukuk and other corporate exercises initiated by the company.

Collective expertise

The Amanie Advisors’ team of experts have extensive experience from diverse and specialized disciplines ranging from Shariah, investment banking, legal, economics, accounting, risk, corporate finance, and strategic planning.

Play Video

Dr. Mohd Daud Bakar

Mainstreaming of Islamic Finance

Play Video

Maya Marissa Malek

Socially Responsible Investments (SRI)

Play Video

Ainul Azura Zakiyudin

Islamic Microfinance

Diverse business network

Amanie is perfectly positioned between the supply and demand side of the Islamic finance industry. This placement allows Amanie to not only transact on globally available opportunities but to also bring more players to the discussion and further the needs of all stakeholders in the Islamic finance space.

Shariah Solutions

Amanie provides end-to-end Shariah solutions for both financial and non-financial clientele. Our best-fit and cutting-edge solutions developed and delivered direct to Amanie’s clients are measured against high-level industry-wide fiduciary and governance standards. Amanie’s core services cover the whole spectrum of Islamic finance and involve consultancy work in various areas including the following key areas:

Amanie develops the solution for any particular arising problem from the market. Amanie will engage with new entities and be briefed on their idea in producing a Shariah-compliant product or new initiative. Amanie’s first question will always be, “What is the economic effect you are looking to achieve?” and we will work backwards from there. Amanie will then, using the expertise of its well-diversified consultants and consulted by its SSB members, structure a Shariah-compliant solution to the product or new initiative where feasible. These will be based on global international standards to ensure that it will be widely acceptable by worldwide countries across the regions. Sometimes it is not possible to mirror the desired economic effect in a Shariah compliant manner and we feel that a quick no is best in these situations.

Amanie Advisors offers a total Shariah outsourcing solution through its specialised Shariah advisory team from various technical backgrounds, guided by the Amanie Shariah Supervisory Board comprised of globally renowned Shariah scholars. This Shariah outsourcing solution ensures accelerated Shariah capabilities within an institution, enabling efficient and speedy time to market, lower capital outlay and fast recognition in the industry.

Amanie works closely with its clients to design and conceptualise a specific financial product which is relevant to the client’s needs, without compromising on Shariah compliance. Amanie prides itself on our ability to arrive at both simple and complex Shariah solutions that provide the precise intended commercial effects our clients need. We have an extensive track record of successfully implemented products across all areas of Islamic finance. Amanie also has wide-ranging expertise on the operational issues, such as those related to legal, risk, accounting & IT aspects of the overall product development process.

In addition to the continuous Shariah supervisory and monitoring services, Amanie undertakes annual Shariah review and audit exercise for the purpose of issuing annual certification on Shariah compliance either at product level or entity level, in line with industry best practices. With its tried and tested Shariah audit methodology, the Shariah audit process not only provides Shariah credibility but also enhances existing practices towards better and more efficient Shariah operationalisation.

Amanie helps its clients establish a proper and sound governance framework designed to support their capabilities within Islamic finance. A robust and comprehensive Shariah Governance Framework allows institutions to offer Shariah-compliant products and services without having to worry about potential Shariah issues arising unexpectedly. The framework and relevant policy documents that follow – drafted by a team with a wealth of expertise in the field – detail all the relevant internal authorities, structures and processes to ensure efficient day-to-day business is conducted in a Shariah-compliant manner.

Amanie Advisors has the requisite expertise for the conversion of a conventional product/activity into a Shariah compliant product/activity while maintaining equivalent economic benefits, where possible. The process includes, among others, mapping a conversion strategy, staff reorientation, process re-engineering

Amanie is a premier provider of Islamic finance talent development programs. We offer high quality educational courses, public workshops and structured in-house training. These programs are designed to provide a comprehensive understanding of various areas of Islamic banking and finance. Our training programs cover the most pressing conceptual and operational issues, along with a heavy dose of practical knowledge by incorporating real-world case studies, exercises, and group work.

Amanie also provides module development services for universities and professional certification bodies. Some of our recent work includes development of modules for CIMA Advanced Diploma in Islamic Finance (CADIF) the CIMA Diploma in Islamic Finance (CDIF) and INCEIF Chartered Islamic Finance Professional qualification.

Amanie undertakes the certain best fit activities and environmental assessments including an assessment of the existing IT environment and a gap analysis against a set of Shariah parameters and international best practices. Subsequently we support the design, management, and evaluation of the processes related to core banking and product systems, ensuring alignment to Shariah parameters as well as business and technology requirements.

Amanie’s team of specialists may assist companies to make informed and empowered market entry, investment, reorganisation, and formation of new entity decisions for Islamic related projects or institutions. Samples of projects that we can deliver are spin-off of Islamic banking window/subsidiary, setting up of a takaful company, formation of a zakat institution, creation of a specialised waqf fund/corporation, building of a pilgrimage administration body, development of an Islamic securitisation house and structuring of an Islamic investment fund, amongst others.

Premier Islamic Finance Consultant since 2005

Training Capabilities

Amanie is the Education Partner of the Accounting and Auditing Organization for Islamic Financial Institutions (“AAOIFI”) and the Chartered Institute of Management Accountants (“CIMA”).

Amanie offers bespoke and tailor-made training programmes for AAOIFI and CIMA courses such as the Chartered Islamic Professional Accountant (“CIPA”) and Certified Shariah Advisor and Auditor (“CSAA”) course under AAOIFI and Diploma in Islamic Finance and Advance Diploma in Islamic Finance under CIMA. Amanie was also the co-developer of the diploma module programmes offered by CIMA.

Contact us to get a discounted rate any of the courses above using our special promotional code.

Besides the above, Amanie also provide bespoke training services to any institutions and will cater the training module and programme to suit the client’s requirements and preference.

Amanie mandates in the news

ComTech Gold $CGO becomes the first 100% Gold backed token

To receive Shariah Certification in the MENA region

Saudi sovereign wealth fund anchors new $300m Shariah credit fund

More sovereign wealth funds set to invest in the region…

EPF launches world’s largest syariah private equity SMA fund with US$600m allocation

We are pleased to act as the Shariah Advisor to…

Shariah Whitepaper on Ether

Amanie Advisors has collaborated with Ethereum Foundation to conduct a…

Contact us

AMANIE ADVISORS LTD

GLOBAL OFFICE, DUBAI

Unit 1304, Tower II

Al Fattan Currency House

Dubai International Financial Centre

PO Box 506837, Dubai

United Arab Emirates

Tel: +9714 388 8576

AMANIE ADVISORS SDN BHD

HEAD OFFICE, KUALA LUMPUR

Level 13A-2

Menara Tokio Marine Life

189, Jalan Tun Razak

50450 Kuala Lumpur

Malaysia

Tel : +603 2161 0260

AMANIE ADVISORS CIS LLC

KAZAKHSTAN OFFICE

Office 1701, 29/1

Konayev Str.

Z05H9D8 Astana

Republic of Kazakhstan

Tel: +603 2161 0260

suhaida@amanieadvisors.com

AMANIE ADVISORS

EUROPE REPRESENTATIVE

5 Hunter’s Court

Hunter’s Way

Leeds LS15 0LB

United Kingdom

Tel: +44 749 645 6915

benjamin@amanieadvisors.com