Team

Global office

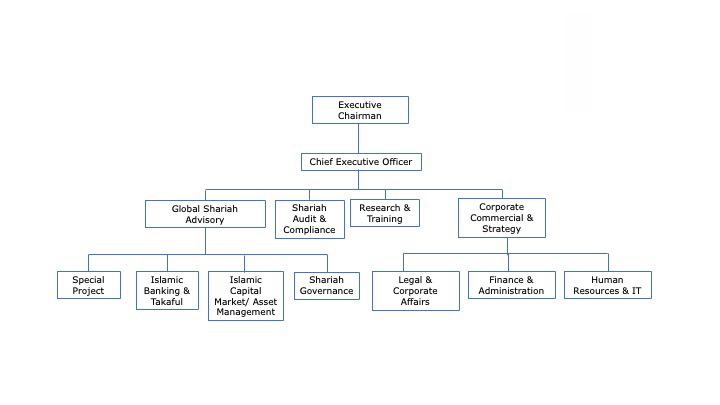

Organization Structure

Global office

Dubai

Sharafie Mohd Daud is the Chief Executive Officer and Director of Amanie Advisors Ltd. (Dubai

Office) based in Dubai

Sharafie Mohd Daud is the Chief Executive Officer and Director of Amanie Advisors Ltd. (Dubai

Office) based in Dubai since 2018. With more than 14 years of specialized experience in Islamic

banking and finance, he is a recognized practitioner in structuring sophisticated Shariah-

compliant solutions across global financial markets.

Sharafie has led complex client engagements involving product innovation, structuring and

syndication, Sukuk issuances, Shariah screening, legal and contractual reviews, and the delivery

of technical training. He has worked extensively with global asset managers, international

banks, fintech firms, platform providers, and takaful operators to develop end-to-end Shariah-

compliant solutions across diverse asset classes, including public and private equities,

commodities, Sukuk, discretionary mandates, Islamic derivatives, and core banking products.

Before joining Amanie Advisors, Sharafie held progressively roles at Affin Islamic Bank, HSBC

Amanah (covering Shariah, Debt Capital Market and Corporate Banking), and Al Rajhi Bank as

Assistant Vice President, Shariah Compliance at Al Rajhi Bank where he was instrumental in

establishing a new Shariah review function within the Compliance Division.

He holds a Bachelor’s degree in Shariah (Islamic Jurisprudence) from Yarmouk University,

Jordan, and has completed CFA Level I.

Idris Mojaddidi is the Executive Director with Amanie Advisors’ global office, based in Dubai.

Idris Mojaddidi is the Executive Director with Amanie Advisors’ global office, based in Dubai. He is a specialist in the area of Shariah, Islamic finance, product development, Shariah governance, structuring, enhancement and Shariah audit. He is a certified Shariah Advisor & Auditor (CSAA) by the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) Bahrain. Idris comes from a Shariah background and has more than 18 years’ of working experience with large financial institutions, government agencies and Islamic finance and Shariah advisory firms and has had the privilege to work closely with globally renowned Shariah scholars. Idris holds a Shariah law bachelor’s degree from Al -Azhar University in Cairo- Egypt. He speaks English, Arabic, Persian and Pashto.

a Certified Islamic Finance Executive (CIFE™) and an Associate Fellow of the Institute of Islamic Banking & Insurance (AFIIBI, London)

Mudhakkir Abdulhamid, a Certified Islamic Finance Executive (CIFE™) and an Associate Fellow of the Institute of Islamic Banking & Insurance (AFIIBI, London), is an Islamic finance professional with extensive experience in Shari’ah audit, compliance, documentation, and governance. With a B.Sc. in Islamic Economics, Banking & Finance and a Post Graduate Diploma in Islamic Banking & Insurance, he is well-versed in both the theoretical and practical aspects of Islamic financial systems.

Currently pursuing Masters in Islamic Finance (eMIF) program at INCEIF University, Malaysia, Mudhakkir is enhancing his skills to address contemporary challenges in the Islamic finance landscape. His Advanced Diploma in Islamic Banking & Fintech from the Geneva School of Business and Economics further empowers him to integrate innovative fintech solutions within the framework of Islamic finance.

Mudhakkir has honed his expertise in banking & Islamic pension funds, ensuring that financial products and services adhere to Islamic principles. His comprehensive understanding of Shari’ah documentation and governance has contributed to the establishment of effective compliance frameworks, promoting integrity within the financial sector.

holds a PhD in Islamic Banking and Finance from the International Islamic University of Malaysia(IIBF-IIUM)

Dr. Vatimetou Mokhtar Maouloud is currently an Associate Shariah consultant at Amanie Advisors. She holds a PhD in Islamic Banking and Finance from the International Islamic University of Malaysia(IIBF-IIUM), complemented by dual master’s degrees—one in Financial Technology with Data Science from the University of Bristol (UoB), UK, and another in Islamic Economics from the University of Sfax (FSEGS), Tunisia, where she also earned her bachelor’s degree in finance.

Dr. Vatimetou is certified in Islamic Finance, holding both the CSAA (Certified Shari’a Adviser and Auditor) designation from the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) and the CIB (Certified Islamic Banker) from the General Council for Islamic Banks and Financial Institutions (CIBAFI). Her linguistic fluency in English, Arabic, and French enables her to engage with diverse stakeholders and contribute to a global discourse on Islamic finance. She is a member of the Chartered Institue of Islamic Finance Professionals(CIIF), and a board member of the Moroccan Center for Islamic Economics (MCIE).

As a seasoned Shari’a advisor and researcher, Dr. Vatimetou combines deep theoretical knowledge with practical expertise, bridging the gap between traditional Islamic finance principles and modern financial technologies.

holds a bachelor’s degree in Islamic Studies from King Faisal University

Yahya Eldersevi is an Associate Consultant at Amanie Advisors Dubai. He holds a bachelor’s degree in Islamic Studies from King Faisal University (Saudi Arabia) and a Master of Comparative Laws from International Islamic University Malaysia (IIUM). Currently, he is pursuing a PhD in Law at the University of Malaya. Before joining Amanie, Yahya worked as a Sharia Auditor with Raqaba for Audit and Islamic Financial Advisory for several years. As part of Amanie’s global team, Yahya is involved in providing Sharia advisory services to clients across all business segmentations: banking, capital market, public & private equities, etc. Moreover, Yahya is fluent in several languages: English, Arabic, Turkish, and Kurdish.

is a communication engineer who offers an overall 18 years of experience

is a communication engineer who offers an overall 18 years of experience including 6 years in formulating and enforcing corporate affairs policies and procedures in addition to communicating strategic business plans and information to various internal departments. Her expertise is in developing, executing, and managing a cohesive business expansion plan by maintaining close communication with all clients, determining their needs and delivering apposite solutions. Previously, she was a Brand Consultant for Lootah Holding, where she created strategies for the company in terms of increasing publicity. Prior to that, she was the Senior Executive of Corporate Affairs for Petronas, based at DIFC from 2013 to 2020. With a degree in Robotics Engineering from the University of Auckland, New Zealand, coupled with more than 10 years of experience in the corporate communication and marketing world, Fahreen is excited to push boundaries for Amanie Advisors.

holds an MBA in banking and insurance from SCMS Business School and works as the Head – Finance & Administration

Nithin Benny holds an MBA in banking and insurance from SCMS Business School and works as the Head – Finance & Administration at Amanie Advisors Global Office Dubai. Finance specialist Nithin has a background in banking, experience in credit risk management, financial services, corporate experience in collections, and knowledge of Islamic trade finance. His initial duties at KPMG India after joining the company in 2012 included managing statutory audits, keeping up client relationships in the area, and driving the development of strategies for the offshore practises to operationalize and implement the service offerings. As a trade finance & factoring services credit analyst, he has previously worked for Tawreeq Holdings and Deem Finance.

Head office

Kuala Lumpur

Suhaida Mahpot is the Chief Executive Officer for Amanie Advisors in Kuala Lumpur office.

Suhaida Mahpot is the Chief Executive Officer for Amanie Advisors in Kuala Lumpur office. She joined Amanie in 2008 and was among the pioneers in the company. She is a specialist in sukuk advisory and has been partnering with Datuk Dr Mohd Daud Bakar for the last 10 years to advise on numerous sukuk, locally and internationally. One of the sukuk advised by her has been awarded as Best Securitisation Sukuk at The Asset Triple A Islamic Finance Award (2017). Apart from sukuk advisory, her primary focus is on Shariah governance, structuring, enhancement and conversion exercises, establishment of Islamic financial entities as well as development of Islamic products. She holds a Bachelor of Economics (Islamic Economic & Finance) from International Islamic University Malaysia, and is currently pursuing MSc in Islamic Finance with INCEIF. Her career in banking & financial industry started as a trainee under Capital Market Graduated Trainee Scheme organized by the SC. Prior to joining Amanie, she worked with Affin Investment Bank Bhd since 2006 as an executive for debt & capital markets department. She completed various project financing deals using private debt securities instruments ranging from infrastructure & utilities, real estate, plantation and many others.

Erna Waty Salihuddin is the COO / Director with Amanie Advisors Kuala Lumpur, Malaysia office.

Erna Waty Salihuddin is the COO / Director with Amanie Advisors Kuala Lumpur, Malaysia office.

She holds a Master’s degree of Islamic Finance Practise (MIFP) from International Centre for Education in Islamic Finance University (INCEIF) and obtained her Bachelor of Management Information System (Hons) from International Islamic University (IIUM), Malaysia. Erna has over 20 years of experience in the area of Islamic finance, business advisory, strategic planning and banking operations. Erna joined Amanie Group in 2015, mainly involved with business advisory before joining the Shariah advisory team in 2018. Prior to joining Amanie, Erna was attached to Bank of Tokyo Mitsubishi UFJ (Malaysia) (BTMUM) Islamic Banking department and she had a stint in Strategy and Portfolio department, EVP Office of Exploration & Production with Petroliam Nasional Berhad (Petronas) where she was involved in strategic planning of the exploration and production of the oil and gas industry for Malaysia. She started her career in banking since 2003 with HSBC, UOB Bank and PT. Bank Muamalat Indonesia (M’sia).

Ainul Azura Zakiyudin is the Director of Amanie Advisors Kuala Lumpur, Malaysia office.

Ainul Azura Zakiyudin is the Director of Amanie Advisors Kuala Lumpur, Malaysia office. She holds Bachelor of Law (Honours), MARA University of Technology Malaysia and was admitted to Malaysian BAR as an Advocate and Solicitor of the High Courts of Malaya in 2000. Azura joined Amanie Advisors (Kuala Lumpur) in 2013 and has been involved in various product structuring, development and enhancement of Shariah compliant products. She has also involved in providing Shariah advisory services for issuance of sukuks, conversion exercises, establishment of Islamic financial business, establishment of Shariah compliant products for non-financial business, Shariah monitoring and compliance review for financial institutions and asset management companies. Prior to joining Amanie, Azura was an in-house legal adviser in PLUS Expressways Berhad (PLUS), where she received wide exposure in corporate legal work and involved directly in the issuance of several sukuks, restructuring of sukuk and other corporate exercises initiated by the company.

Ahmad Anas Fadzil (CSAA, CIPA) is a registered Shariah Advisor with the Securities Commission of

Malaysia and the Director with Amanie Advisors.

Ahmad Anas Fadzil (CSAA, CIPA) is a registered Shariah Advisor with the Securities Commission of

Malaysia and the Director with Amanie Advisors. He is also a Professional Accountant by

profession. Currently, he is based at the Head Office in Kuala Lumpur. As part of Amanie Advisors’

global team, his primary focus is on advising and consulting Clients from various Islamic financial

institutions, regulators and corporations across the globe on Shariah compliant products,

instruments and other services as well as on their strategic and corporate issues.

Prior to joining Amanie Advisors, he was attached with Sigur Ros, a global Malaysian-based company

for Turkey Government’s Project of the Century known as the Turkish Republic North Cyprus Water

Supply project where he had been assigned as the Project Accountant based in Turkiye overseeing

the project cost budgeting, project cost management, project reporting, project financing as well

other administrative matters including handling the local tax authority and local bodies.

Prior to that, he was an external auditor with Messrs. Ernst & Young based in Kuala Lumpur,

whereby he was attached to the Global Financial Services department, engaged in performing

auditing work for the financial institutions including Maybank, Bank of Tokyo-Mitsubishi,

Permodalan Nasional Berhad (PNB), EXIM Bank Berhad and Malaysian Electronic Payment Systems

(MEPS).

He holds a professional certification of Certified Sharia’ Adviser and Auditor (CSAA) and Certified

Islamic Public Accountant (CIPA) both from Accounting and Auditing Organisation for Islamic

Financial Institution based in Bahrain (AAOIFI) as well as Masters of Islamic Finance (MSc) from The

Global University of Islamic Finance (INCEIF). He is also an accounting graduate from MARA

University of Technology (UiTM) and an Executive Diploma in Shariah holder from University of

Malaya Centre for Continuing Education (UMCCed). He speaks Bahasa Melayu, English and Turkish.

Ahmad Faizul Rizal is a Associate Director at Amanie Advisors (Head Office).

Ahmad Faizul Rizal is a Associate Director at Amanie Advisors (Head Office). Faizul holds a Bachelor’s Degree of Shariah in Islamic Banking and Economics from Yarmouk University, Jordan. Prior to joining Amanie, He started as a trainee under Islamic Capital Market Graduate Trainee Scheme organized by SIDC. (The training and development arm of the Securities Commission Malaysia (SC) and subsequently passed SC Licensing Examination – Module 6 (Stock Market & Securities Laws) and Module 7 ( Financial Statement Analysis & Asset Valuation). Shortly after, he joined Kenanga Investment Bank Berhad and worked as Senior Associate for Credit Equity Broking department where he was in charge of Share Margin Financing division and its related activities including stockbroking activity.

Muhammad Hafizuddin is a Associate Director at Amanie Advisors Kuala Lumpur, Malaysia

Muhammad Hafizuddin is a Associate Director at Amanie Advisors Kuala Lumpur, Malaysia. He graduated with a Bachelor of Business Administration (HONS) Islamic Banking from Universiti Teknologi Mara (UiTM).

Previously, he was internship trainee where he was exposed to the financial and Shariah advisory services such as Shariah stock screening, monitoring and compliance reviewto various clients including financial institutions and global asset management companies. He then started his career in Amanie Advisors Sdn Bhd in December 2018 after he was offered a position there.

Nurain Mohd Zarir is Associate Director at Amanie Advisors’ Malaysia Headquarters.

Nurain Mohd Zarir is an Associate Director at Amanie Advisors’ Malaysia Headquarters. She is responsible for Shariah screenings of stocks and fixed-income securities, Shariah monitoring & compliance reviews of unit trust funds, and asset management company operations. Nurain received her Masters of Islamic Finance Practice (MIFP) from the International Centre for Education in Islamic Finance University (INCEIF) and her Bachelor of Business Administration (Hons) in Islamic Finance from the University of Kuala Lumpur Business School in Malaysia. Prior to joining Amanie, Nurain is a compliance executive for AmBank Berhad where she was responsible for ensuring the compliance of the bank’s division. Her career in banking and finance began as a trainee under the Islamic Capital Market Graduate Training Scheme, which was organised by the Securities Industry Development Corporation (SIDC) in conjunction with the Securities Commission (SC).

Sheikh Hazman is an Associate Director with Amanie Advisors Kuala Lumpur, Malaysia office

Sheikh Hazman is an Associate Director with Amanie Advisors Kuala Lumpur, Malaysia office where he has been actively engaged in

Shariah advisory services and supervision for Islamic fund management. His work involves Shariah stock screening, compliance reviews, and

providing guidance to various clients. In addition, Sheikh Hazman plays a key role in the structuring, development, and enhancement of

Shariah-compliant products. He is also a recognized expert in Islamic wealth management, specializing in the implementation of Hibah,

Trusts, Wills, Faraid, and other related matters.

Before joining Amanie, Sheikh Hazman worked as a Legal Associate at prominent law firms, including Ram Reza & Muhammad. He was

admitted as Syarie Counsel for the Federal Territories, State of Selangor Darul Ehsan, and State of Negeri Sembilan Darul Khusus. During his

time in the legal field, he provided expert advice on the structuring of Islamic finance products and contracts.

In terms of education, Sheikh Hazman completed his Bachelor Degree at Al-Azhar University in Cairo, Egypt, where he graduated from the

Faculty of Shariah and Law, majoring in Shariah Islamiyyah. Furthering his academic qualifications, he obtained a Postgraduate Diploma in

Law and Administration of Islamic Judiciary from the International Islamic University Malaysia (IIUM) in 2022. He then completed his Master

of Law (LLM) in Islamic Banking and Finance at IIUM in 2024

Amni Farihah is an Associate Director at Amanie Advisors’ Malaysia Headquarters

Amni Farihah is an Associate Director at Amanie Advisors’ Malaysia Headquarters, bringing valuable experience from her previous role in

an investment management company. She has played a dynamic role in collaborating with cross-functional teams on Shariah investment

matters and supports client relationship managers to ensure that the needs of institutional clients are met with the ethical standards.

Holding a Bachelor of Finance (Islamic Finance) from the International Islamic University Malaysia (IIUM), her solid academic foundation has

cultivated a strong interest in the Islamic capital market. Her passion drives her to continuously pursue innovative, Shariah-compliant

solutions that foster growth in financial services. At Amanie, she is dedicated to working closely with a committed team to develop and

implement a comprehensive range of Islamic finance initiatives.

Europe

United Kingdom

Benjamin Clarehugh is a Executive Director of Amanie Advisors based in Leeds, United Kingdom.

Benjamin Clarehugh is a Executive Director of Amanie Advisors based in Leeds, United Kingdom. He is responsible for Shariah screening of equity & fixed income securities, Shariah monitoring & compliance review of unit trust funds and the operation of asset management companies. Benjamin is also assisting the Shariah advisory team in structuring and developing Islamic Capital Market products. Prior to joining Amanie Advisors Sdn Bhd, he worked with Kuwait Finance House Research Ltd. as a Manager in the Islamic Capital Markets department. He completed various research and advisory/consultancy projects with various global Islamic finance institutions and partners.

Abdulaziz Goni has 10 years of experience in the Islamic finance industry.

Abdulaziz Goni has 10 years of experience in the Islamic finance industry. In 2011, he joined Thomson Reuters Malaysia, initially as a client specialist responsible for maintaining relationships with regional clients, mainly fund managers, financial institutions and pension funds – he was part of the team that developed a Bond and Sukuk index that became a benchmark index for Malaysian fund managers. He moved to Dubai in 2016 as a Senior Research Analyst with Refinitiv (formerly part of Thomson Reuters) where he was responsible for writing and publishing reports covering Islamic finance development and quarterly reports on sukuk markets.

Abdulaziz holds a Master’s degree in Islamic finance from INCEIF, and has passed level I of the CFA program.